The American Cancer Society has identified a disparity in cancer death rates, noting that persons with lower socioeconomic status have higher rates of mortality.1 This is attributed to many factors, but it is largely owing to the higher burden of disease among lower-income individuals.1 A component of this disease burden is measured by assessing the patient-reported outcome of cancer-related distress. The National Comprehensive Cancer Network (NCCN) Distress Management Guidelines have defined distress as “a multifactorial unpleasant emotional experience of a psychological (cognitive, behavioral, emotional), social and/or spiritual nature that may interfere with the ability to cope with cancer, its physical symptoms and its treatment.”2

Financial hardship related to cancer diagnosis and treatment is increasingly being recognized as an important component of disease burden and distress. The advancements in costly cancer treatments have produced burdensome direct medical costs as well as numerous indirect costs that contribute to perceived financial hardship.3,4 These indirect costs include nonmedical expenses such as increased transportation needs or childcare, loss of earnings, or loss of household income due to caregiving needs.3 Moreover, indirect costs are often managed by patients and families through their use of savings, borrowing, reducing leisure activities, and selling possessions.3 Even though efforts to increase health coverage, such as the Affordable Care Act, have reduced the rates of individuals who are uninsured, persons with cancer who have insurance also face challenges because they cannot afford copays, monthly premiums, deductibles, and other high out-of-pocket expenses related to cancer treatment that are not covered by their insurance such as out-of-network services or providers.5-7

Thus, financial hardship may have an impact on several areas of a patient’s life and well-being, but the effects are commonly undetected.8-10 Research has established that financial strain can influence treatment choices and adherence to therapy.11 Furthermore, the effects of financial strain have been identified across the cancer care continuum, from diagnosis through survivorship, suggesting a bidirectional relationship between financial strain and well-being.11 Financial strain may reduce patient quality of life and worsen symptom burden because of the patient’s inability to access needed care, poor social supports, and/or increased stress.11-12 These worsening outcomes may also increase the use of financial reserves and affect their ability to work.7,11 Financial difficulties may also be associated with anxiety and depression, leading to worse quality of life and greater distress and symptom burden.12 Identifying groups at high risk for financial strain is crucial to ensure that resources are available to assist these populations.13 This burden can be even more pronounced in minority and underserved patients with cancer.7 Patients with advanced cancer are especially vulnerable to the burden of increased costs because of the use of expensive targeted therapies; their improved survival, which extends the time of expenditure; and increased use of financial reserves.9 Financial hardship in patients with advanced cancer is not well understood or characterized,9 which is why this study aimed to better quantify distress in advanced stage cancers by describing :

▪ A cohort of patients with advanced cancer and their levels of quality of life, symptom distress, cancer-related distress and perceived financial hardship;

▪ The relationship between perceived financial hardship, quality of life, symptom distress and overall cancer-related distress; and

▪ Quality of life, symptom distress, and overall cancer-related distress according to level of perceived financial hardship.

Methods

This study is a cross-sectional, descriptive, comparative study of distress, including perceived financial hardship, among patients with advanced cancer who were receiving palliative care treatment in two outpatient medical oncology clinics in Western Pennsylvania. The data were collected during May 2013-November 2014. The study protocol was approved by the Institutional Review Board at the University of Pittsburgh. Eligible participants had to be 18 years or older and have an advanced solid tumor of any kind, with a prognosis of 1 year or less confirmed by a physician or clinic nurse practitioner/physician assistant, and be able to read and understand English at the fourth-grade level. The sample was recruited from two clinics at the University of Pittsburgh Cancer Institute, a National Cancer Institute-designated Comprehensive Cancer Program.

Measurements

Sociodemographic factors. These were measured using an investigator-derived Sociodemographic Questionnaire, a 12-item form that includes variables such as age, race, marital status, cancer type, religion and spirituality, employment status, years of education, health insurance status, and income level.

Cancer-related distress. The NCCN Distress Thermometer is a self-report visual analog scale (0, no distress; 10, great distress) formed in the shape of a thermometer combined with a problem list that is often used in outpatient cancer settings for reporting of cancer-related distress.14-16 The sensitivity, specificity and convergent validity with the Brief Symptom Inventory and the Hospital Anxiety and Depression Scale have been established and appropriate cut-off score of the distress thermometer identified.14-16 A score of 4 or above indicates a clinically significant level of distress.14-16

Symptom distress. The McCorkle Symptom Distress Scale was developed in 1977 based on interviews that focused on the symptom experiences of patients. Psychometric testing among patients with cancer using the modified Symptom Distress Scale revealed high reliability (Cronbach alpha, 0.97).17 The instrument is a 13-item Likert scale (1-5) assessing the severity of distress experienced by a symptom. Total scores range from 13 to 65, where a higher score indicates greater distress. Moderate distress is indicated with a score of 25-33, and a score above 33 indicates severe distress, identifying the need for immediate intervention.17

Quality of life and spiritual well-being. The Functional Assessment of Cancer Therapy (FACT-G) is used to assess general cancer-related quality of life. It has four subscales: physical, emotional, social and family, and functional well-being, with a total score that ranges from 0-112, where higher scores show higher quality of life. The Spiritual Distress Well-Being questionnaire was used alongside the valid FACT-G assessment.18,19 The Spiritual Well-Being Short Form was developed with an ethnically diverse population and adds 12 items to the FACT-G. The items do not necessarily assume a faith in God, allowing a wide flexibility in application and tapping into issues such as faith, meaning, and finding peace and comfort despite advanced illness. Higher scores on the Spiritual Well-Being subscore (range, 0-48) are correlated with higher scores of quality of life. The possible scores for the combined FACT-G and Spiritual Well-Being assessment range from 0-160, with higher scores showing higher quality of life.

Economic hardship. Perceived financial hardship was measured using Barrera and colleagues’ Psychological Sense of Economic Hardship Scale. 20 The scale consists of 20-items broken down into 4 subscales: financial strain, inability to make ends meet, not enough money for necessities, and economic adjustments.20 Economic adjustments in the 3 months before administration of the questionnaire were assessed with 9 Yes or No items, such as added another job, received government assistance, or sold possessions to increase income. The subscale of not enough money for necessities was assessed with seven 5-point scale items in which respondents noted whether they felt they had enough money for housing, clothing, home furnishings, and a car over the previous 3 months. Inability to make ends meet included two 5-point scale items that assessed the difficulty in meeting financial demands in the previous 3 months. Financial strain consisted of two 5-point scale items concerned with expecting financial hardships in the coming 3 months. Scores can range from 20-73, with a higher score indicating worse economic hardship.

Data collection and analysis

In-person data collection occurred in the clinical waiting area before the clinician visit or in the treatment room with the patient using a consecutive, convenience sample. The nursing staff checked the clinic lists daily for possible patient participants. Patients with metastatic cancer were identified and then approached for consent. After we had received the patient’s consent, the administration of the instruments took about 20 minutes to complete. The data were then entered and verified in REDCap (Research Electronic Data Capture), which is hosted at the University of Pittsburgh.21The levels of symptom distress, quality of life, perceived financial hardship, and cancer-related distress were described through continuously measured variables. Descriptive statistics, measures of central tendency (mean and median), and dispersion (standard deviation and range), were obtained for the subscales and total scores. Correlation analysis was used to describe the relationship between perceived financial hardship and quality of life, symptom distress, and cancer-related distress. These primary outcome variables were further explored according to the level of dichotomized perceived financial hardship using mean score as the cut point. Independent sample t tests were used to compare patients experiencing high perceived financial hardship with those experiencing low perceived financial hardship.

Results

In all, 100 patients participated in the study. Any missing data points were replaced with the mean score for that variable, although this was minimal in this study. Most of the participants were women (67%), and the average age of the participants was 63.43 years (SD, 13.05; Table 1). Of the total number of participants, 73% were white, 26% were black, and 1% were Asian. Most of the participants were either retired and not working (39%) or disabled or unable to work (34%). Almost all of the participants had some form of insurance, with 99% having either private or public health insurance. A variety of cancer types were represented in this patient population, with higher percentages of breast (25%), gynecologic (10%), lung (19%), and colon/rectal cancer (15%). Of the total number of participants, 35% had annual household incomes below $20,000, and 50% had annual household incomes of more than $20,000. On average, participants had 13.48 years (SD, 2.78) of formal education.

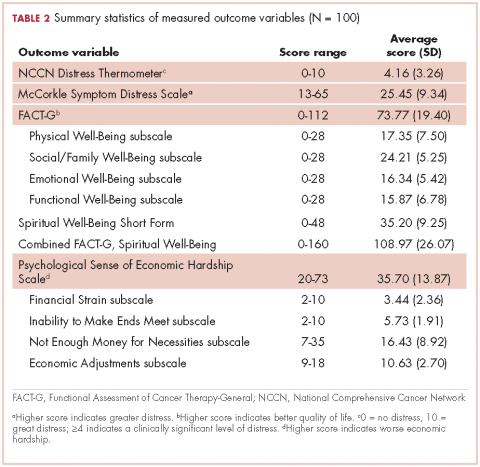

Descriptive statistics for the primary outcome variables can be found in Table 2. The average score for cancer-related distress based on the NCCN Distress Thermometer tool was 4.16 (SD, 3.26). The average score for the McCorkle Symptom Distress measurement was 25.45 (SD, 9.34). For quality of life, the average FACT-G total score was 73.77 (SD, 19.40). Of the FACT-G subscale average scores, physical well-being was 17.35 (SD, 7.50), social/family well-being 24.21 (SD, 5.25), emotional well-being 16.34 (SD, 5.42), and functional well-being 15.87 (SD, 6.78). Participants’ average score for the spiritual well-being measure was 35.20 (SD, 9.25) and the combined FACT-G and spiritual well-being average score was 108.97 (SD, 26.07). The total average score for perceived financial hardship was 35.70 (SD, 13.87), with subscale average scores of 3.44 (SD, 2.36) for financial strain, 5.73 (SD, 1.91) for inability to make ends meet, 16.43 (SD, 8.92) for not enough money for necessities, and 10.63 (SD, 2.70) for economic adjustments.

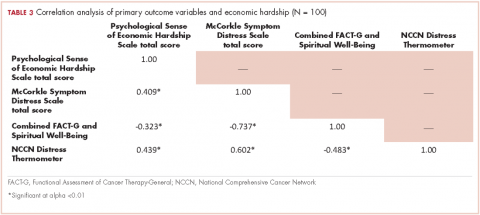

We conducted a bivariate correlation analysis to assess the relationship between perceived financial hardship and three other primary outcome variables (Table 3). These analyses showed significant low to moderate correlations with overall cancer-related distress (r, 0.439; P < .001), symptom distress (r, 0.409; P < .001) and overall quality of life scores (FACT-G and spiritual well-being combined score: r, -0.323; P < .001).

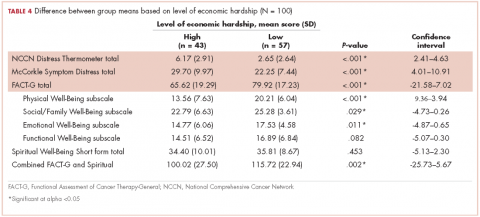

Forty-three participants reporting high perceived financial hardship experienced worse quality of life overall (FACT-G and spiritual well-being; P = .002), worse FACT-G total scores (P < .001), worse physical well-being (P < .001), worse social/family well-being (P = .029), worse emotional well-being, and no significant difference for functional (P = .082) or spiritual well-being (P = .453), compared with those with lower economic hardship. In overall cancer-related distress, participants with higher perceived financial hardship reported higher levels of cancer-related distress (P < .001) than those with lower perceived financial hardship. For those participants reporting higher perceived financial hardship there was also worse symptom distress (P < .001), compared with those with lower economic hardship (Table 4).

Discussion

Overall, this report provides data to illuminate our understanding of disparities in well-being that may be present in patients with advanced cancer. Our analysis found that patients with advanced cancer who have higher perceived financial hardship have significantly higher overall cancer-related distress, symptom distress, and poorer overall quality of life. In this study’s population of patients with advanced cancer, the most notable areas of economic hardship identified by participants were: not having enough money for necessities in the 3 months before the survey and the inability to make ends meet during the same time span, with difficulty paying bills and not having enough money left at the end of the month being most noteworthy among this study’s patient population. Financial strain and making economic adjustment were not as notable in the category of perceived financial hardship.

In regard to not having enough money, participants most commonly cited not being able to afford everyday necessities such as food, clothing, medical care, or a home, as well as leisure and recreational activities. These findings are further supported with the positive, moderate associations between perceived financial hardship and symptom distress and overall cancer-related distress found in this cohort of patients with advanced cancer and the negative, moderately associated relationship between perceived financial hardship and overall quality of life in this study’s sample.

Although these findings have been confirmed in the literature on cancer-related distress, our findings add to our knowledge on both economic and cancer-related distress exclusively in patients with advanced cancer.9,22 The broader cancer-related distress literature has also found an association between being younger and having a lower household income as risk factors for increased financial hardship; however, the perception of financial strain and magnitude was a more significant predictor of quality of life and perception of overall well-being.6,8-9,12,22-23 Furthermore, patients with cancer who noted having higher financial distress typically reported decreased satisfaction with cancer care which also influenced their adherence to treatment and quality of life.24

Our work now adds the important element of perceived financial hardship to the advanced cancer-related distress puzzle. We should consider integrating a financial distress assessment into routine cancer care, particularly with patients and families with advanced cancer, to proactively and routinely assess and intervene with available distress mitigating resources. Therefore, understanding the patients most likely to experience financial distress will help personalize supportive therapy.

This study’s results as well as the existing literature describing financial distress support the use of comprehensive screening instruments to capture elements of financial burden beyond out-of-pocket costs.8,25 This screening is particularly relevant because we are increasingly recognizing that gross annual household income does not always reflect financial hardship or distress. The instrument we used for this analysis, the Psychological Sense of Economic Hardship, provides a broad view of financial toxicity including the specific components of financial strain, the inability to make ends meet, not having enough money for necessities, and economic adjustments experienced by patients with advanced cancer.20 Another measure to evaluate financial toxicity among patients with cancer includes the Comprehensive Score for Financial Toxicity (COST), which is a widely used patient-reported outcome measure. It was developed with input from both patients and oncology experts.25 Use of a financial toxicity assessment tool adds to our understanding of the economic financial burden experienced by patients with cancer, specifically those with advanced cancer.

Tucker-Seeley and Yabroff have identified several areas in which the research agenda for financial toxicity should focus, including: documentation of the socioeconomic context among patients across all areas of the cancer care continuum, further identification and characterization of at risk populations to address health disparities, and the inclusion of cost discussions in the health care context.26 Furthermore, research is needed to identify key areas to target for interventions addressing financial toxicity, such as addressing lack of financial resources to cover the cost of cancer care, focusing on managing or preventing the distress that results from a lack of financial resources, or addressing coping behaviors used by families to manage the financial burden of cancer care.26 Although cost discussions between health care providers and patients have been identified as important in reducing the financial burden of cancer care, the content, timing, and goals of those discussions still need to be better articulated for different patient populations, including patients with advanced cancer.3,27-28 In addition, resources such as social workers, patient navigators, or financial counselors have been identified as effective in assisting patients with financial planning and accessing community resources to address financial burden and assistance.4

Design considerations

This study has limitations that need to be noted. Its cross-sectional design does not allow for the analysis of causal inferences. In addition, certain groups were underrepresented in this study’s sample, including uninsured patients, men, and some minority groups, which may have underestimated the amount of financial burden experienced by patients with advanced cancer. The lack of representativeness of uninsured individuals may be a result of the eligibility of persons with advanced cancer for Medicaid. However, a strength of this study is its ability to increase the representativeness of African American/black patients in the study of advanced cancer and financial hardship. In our study, just over a quarter of the participants (26 of 100; 26%) were black/African American, compared with the US Census Bureau’s national census level of 13.3% and 13.4% in Allegheny County, Pennsylvania .29

The lack of employed participants in this study could be because many were not able to work because of the advanced stage of their disease. The low level of partnered status is a limitation, although one study site was a low-income hospital where one generally tends to see higher levels of unpartnered status. This study did not control for demographic information such as gender or age, thus, the relationships between the primary outcome variables and financial hardship may be overestimated. Moreover, this analysis of financial distress is limited to the context of the United States due to our lack of universal health care and unique payment system. Although we included only patients who were in the palliative phase of cancer treatment, no medical record review was conducted to determine previous cancer history and treatments, which might have provided more insight into other financial loss or cost of cancer treatment. Furthermore, we note that it can be difficult to prognosticate with accuracy and identify that some patients with advanced cancer may have been excluded from the study due to the inclusion criteria of less than 1 year of survival.

Conclusion

Perceived financial hardship is an important assessment of the burden placed on patients due to the cost of disease; and is a good start in assessing indirect costs that patients take on when coping with advanced stages of cancer and can shed light on an aspect of distress experienced by this patient population that is not commonly addressed. Subjective measures of perceived financial hardship complement objective measures that are commonly indicative of economic resources and can further our understanding of the impact of financial distress experienced by patients with cancer. Further study of financial impacts of advanced cancer as well as predictors of financial distress are essential to the early identification of financial hardship and the development of interventions to support those at high risk or experiencing financial distress.

Acknowledgments

The authors acknowledge the patients and staff at the UPMC Mercy Cancer Center in Pittsburgh, Pennsylvania, who made this study possible, and Peggy Tate for her role in data collection. They also recognize the support of the Robert Wood Johnson Foundation through the Future Nursing Scholars program. They would also like to acknowledge that permission was granted for the use of the Psychological Sense of Economic Hardship study instrument.