Five years of low growth in national health spending expenditures reversed substantially in 2014, driven by new Affordable Care Act coverage mandates and higher prescription drug spending, largely for new hepatitis C treatments.

U.S. health spending climbed to $3 trillion and grew by 5.3%, as compared with 2013 when growth was 2.9%. Per capita spending in 2014 was up 4.5% to $9,523 from $9,115 in 2013, according to Centers for Medicare & Medicaid Services Office of the Actuary (Health Affairs. 2015 Dec 2 doi: 10.1377/hlthaff.2015.1194).

Anne B. Martin, an economist with actuary’s office, said the 2014 numbers reversed several years of historically low spending growth that tracked with the sluggish economy. She attributed the uptick in growth to the ACA’s access mandates as well as prescription drug purchases, namely those for HCV, which added $11.3 billion in new spending.

“We can’t necessarily say that the [low-growth] cycle has been broken, but this 2014 phenomenon is driven primarily by the ACA expansion and the one-time impact of bringing the new hepatitis C drug into the 2014 mix,” Ms. Martin said.

Between 2013 and 2014, 8.7 million additional patients were enrolled in public and private health insurance, bringing the total insured share of the population from 86% to 88.8%, the highest coverage rate since 1987, according to Ms. Martin and her colleagues.

The growth rate for private health insurance spending went from 1.6% in 2013 to 4.4% in 2014. The $991 billion spent reflected the addition of 2.2 million newly insured patients, and higher rates of spending on medications, clinical services, and inpatient care, compared with 2013.

Federal government spending grew the fastest in 2014 at 11.7%, an 8.2% faster growth rate than in 2013.

In 2014, 28% of all health care purchases were made by the federal government, up from 26% in 2013.

Medicaid-specific spending totaled $495.8 billion, an 11% growth rate in 2014, up from 5.9% in 2013, reflecting the addition of 7.7 million Medicaid enrollees, various increases in prescription drug rebates, and updated provider fees.

Medicare spending jumped to 5.5%, up from 3.0% in 2013, largely due to prescription drugs, although Micah Hartman, a statistician in the Office of the Actuary, said that the per-enrollee spending rate was 2.4% in 2014, up from –0.2% in 2013, which was due to physician and clinical services, higher administrative costs, as well as the net cost of insurance, including fees and administrative costs.

Mr. Hartman singled out Medicare Advantage as a key contributor, noting that the 9.7% increase in growth for that program was from ACA-stipulated fees.

Overall, pharmaceutical spending was $297.7 billion in 2014, according to the report, attributable to novel HCV drugs, other new treatments, fewer-than-normal patent expirations and, in some cases, a doubling of the costs for certain brand-name drugs. The overall 2014 pharmaceutical expenditure growth rate was 12.2%, compared with 2.4% in 2013, the largest differential since 2002.

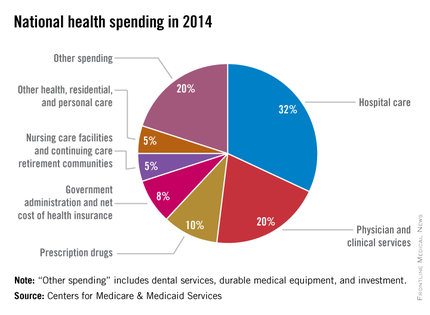

Physician and clinical services in 2014 went from a growth rate of 2.5% to 4.6%, with total spending at $603.7 billion. Hospital spending last year was $971.8 billion, with a spending growth rate of 4.1%, compared with 3.5% in 2013.

On Twitter @whitneymcknight