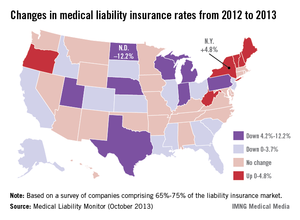

Physicians in most states saw no change in their medical liability insurance premiums in 2013, with more than 55% of premium rates remaining steady across the country.

But amid the stable market, vast disparities persist.

Internists in South Florida will pay $47,707 for malpractice insurance this year while their peers in Minnesota will pay just $3,375. For ob.gyns., malpractice insurance is most expensive in the New York counties of Nassau and Suffolk, where women’s physicians will pay $227,889 in malpractice premiums this year. But in Central California, ob.gyns. will pay just $16,240.

The range can be attributed to tort reform measures, state law, and the overall legal climate of each jurisdiction, said Chad C. Karls, editor of the Medical Liability Monitor's Annual Rate Survey, a yearly survey and analysis of premiums nationwide. The MLM survey gathers July 1 premium data from the major medical malpractice insurers and examines rates for mature, claims-made policies with $1 million/$3 million limits for internists, general surgeons, and ob.gyns.

"It has much to do with the cultural differences," said Mr. Karls, principal and consulting actuary for Milliman in Brookfield, Wis. "There is a higher propensity to bring litigation in some states as opposed to other parts of the country."

Insurance analysts attribute the flat market in part to fewer malpractice claims being filed.

"The biggest driving factor has been the decline in [lawsuit] frequency that occurred in 2004-2005, largely driven by tort reform efforts as well as attorneys simply having greener fields to plow," said Rob Francis, chief operating officer of the Doctors Company, a national medical liability insurer.

But Mr. Francis noted that while fewer claims are being filed, the cost of individual claims has grown. That means it’s likely only a matter of time before the price of jury awards and defense costs outpace the frequency of suits, Mr. Francis said.

Attorney Teresa Knoedler wasn’t surprised to hear that Minnesota leads the nation in low medical liability premiums. The state has a primarily positive legal climate for physicians. She noted that juries are reasonable, the populace is fiscally conservative, and a pretrial certificate of merit is required.

"We’re not seeing the ob.gyns. leaving in droves or the radiologists shutting down," said Ms. Knoedler, policy counsel for the Minnesota Medical Association. "Physicians still have worries, but in a more friendly climate, they can relax at least a little and enjoy the tough work they do."

By contrast, New York physicians are consistently leaving the state because of an unmanageable liability market, said Dr. Sam Unterricht, a Brooklyn ophthalmologist and president of the Medical Society of the State of New York.

"It’s having a big effect," he said. "A lot of doctors are retiring, many are leaving the state, and the satisfaction that physicians have in their professional life is pretty much at an all-time low."

Respondents to this year’s MLM survey expressed significant concern about whether the Affordable Care Act will influence premium rates.

The question has not been answered definitively, but insurance experts say the law and ongoing health care changes could in fact, contribute to more lawsuits – thus rising rates. Because medical professionals are caring for a greater population, patients will likely receive less time during medical visits, said Brian K. Atchinson, president and CEO of PIAA, *a national trade association that represents medical liability insurers. In addition, more nonphysician providers mean patients will probably see their preferred physician less often, he said.

"This may lead to [patients] being less satisfied," Mr. Atchinson said. "When you have patients that are less satisfied in this country, that can lead to consumer complaints. That can lead to lawsuits."

On the other hand, as more physicians move to larger health systems and hospitals, the solo and small practice insurance market becomes more competitive, Mr. Francis said. In such a market, more insurers are vying for a smaller physician base.

"This could drive premiums down even harder because [insurers] are afraid to lose their long-term customer base," he said. "They may be willing to overly discount those rates."

*CLARIFICATION (10/15/13): A previous version of this story misidentified Brian Atchinson in the photo caption. This story also incorrectly described the PIAA. This story has been updated.