according to the personal financial website WalletHub.

Economic and societal losses related to 37.8 million U.S. tobacco users – including out-of-pocket spending for cigarettes, health care expenses, and lost income – top $300 billion annually, but those costs vary considerably by state, WalletHub said in a recent report.

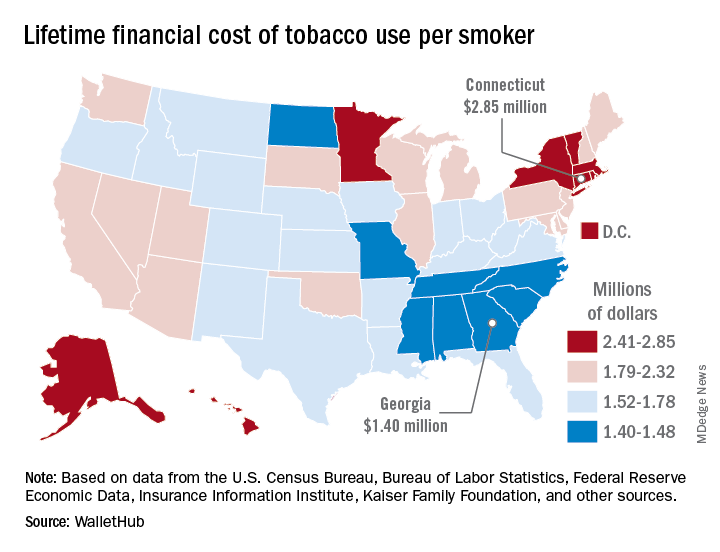

The state with the highest lifetime cost per smoker is Connecticut, with an estimated total of $2.85 million. That works out to just under $56,000 a year for 51 years because lifetime use was defined as one pack a day starting at age 18 years and continuing until age 69 years. New York has the second-highest lifetime cost, which also rounds off to $2.85 million, followed by the District of Columbia ($2.81 million), Massachusetts ($2.76 million), and Rhode Island ($2.68 million), WalletHub said.

Georgia has the lowest lifetime cost of any state – $1.40 million per smoker – followed by Missouri at $1.41 million, North Carolina at $1.42 million, Mississippi at $1.43 million, and South Carolina at $1.44 million, according to the report.

WalletHub’s formula for total lifetime cost has five components: out-of-pocket cost (one pack of cigarettes per day for 51 years), financial opportunity cost (defined as “the amount of return a person would have earned by instead investing that money in the stock market”), health care cost (spending on treatment for smoking-related health complications), income loss (an average 8% decrease caused by absenteeism and lost productivity), and other costs (loss of a homeowner’s insurance credit and costs of secondhand exposure).

The analysis was based on data from the U.S. Census Bureau, Bureau of Labor Statistics, Centers for Disease Control and Prevention, Insurance Information Institute, Campaign for Tobacco-Free Kids, NYsmokefree.com, Federal Reserve Economic Data, Kaiser Family Foundation, and the Independent Insurance Agents & Brokers of America.