The average debt of graduating medical students today is $190,000, which has increased from $32,000 since 1986 (or the equivalent of $70,000 in 2017 dollars when adjusted for inflation).1 This fact is especially disconcerting given that medical trainees and professionals are not known for being financially sophisticated, and rising levels of high-interest educational debt, increasing years of training, and stagnant or decreasing physician salaries make this status quo untenable.2 Building foundational financial literacy and establishing good financial practices should start during medical school and residency; these basics are a crucial component of long-term job satisfaction and professional resilience.

One prominent physician finance writer advocates that residents should consider the following 5 big-ticket financial steps: acquire life and disability insurance, open a Roth IRA, engage yearly in some type of financial education, and learn about billing and coding in your specialty.3 These exercises, except life insurance for a resident without dependents, are all nonnegotiable, yet alone are insufficient actions to build a solid financial foundation. The purpose of this article is to address additional steps every resident should take, including establishing a workable budget, learning how and why to calculate net worth yearly, determining what percentage of income to save for retirement and basic investing strategies, and managing student loans.

Establish a Workable Budget

Living on a budget is a form of reality acceptance. It may feel impossible to save or budget on a resident salary, but residents earn approximately the median US household income of $59,039, according to the US Census Bureau from September 2017.4,5 There are many tools that can be used to create a budget and to track monthly expenses. However, the simplest way to budget is to pay yourself first with automatic deductions to retirement and savings accounts as well as automated bill payments. Making a habit of reviewing all expenses at the end of every month allows you to see if expenditures remain aligned to your personal values and to reallocate funds for the upcoming month if they are not.

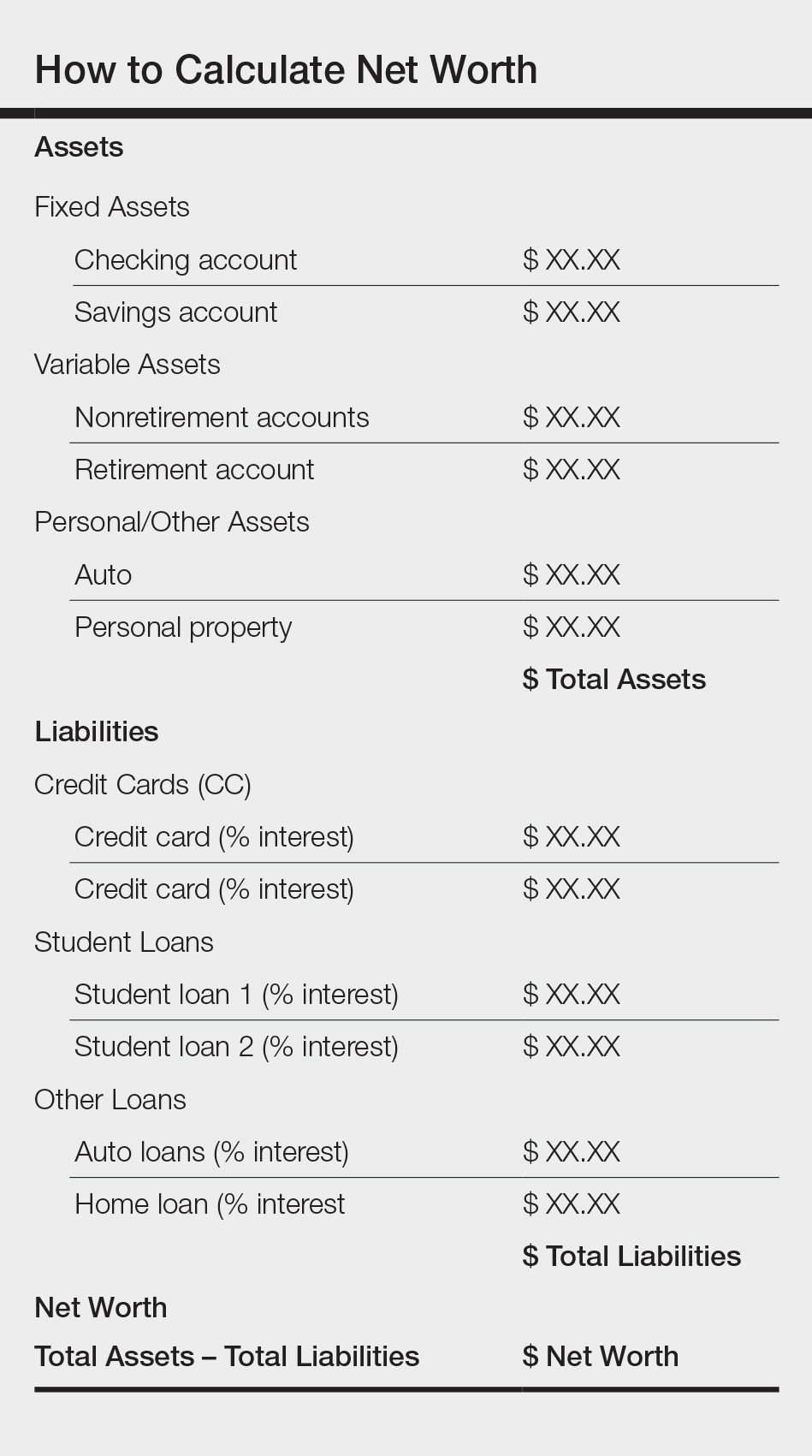

Calculate Net Worth Yearly

Calculating personal net worth may appear to be a discouraging activity to advocate for residents, as many will have a negative 6-figure net worth. The purpose is two-fold: Firstly, to compel you to become well acquainted with your varying types of debt and their respective interest rates. Secondly, similar to taking serial photographs of vitiligo patients to monitor for improvement, it may be the only thing in a long slow slog that indicates beneficial change is occurring because small daily efforts over time yield surprisingly impressive results and the calculation factors in both debt repayment and contributions to all savings vehicles. An example of a simplified method to calculate net worth is demonstrated in the Table.