An important caveat, however, is that data for this year’s report were collected prior to Feb. 11, 2020, as part of the Medscape Physician Compensation Report 2020. The financial picture has changed for many physicians since then because of COVID-19’s impact on medical practices.

While it will be some time before medical practices become accustomed to a new version of normal, the report data provide a picture of the debt load and net worth of neurologists.

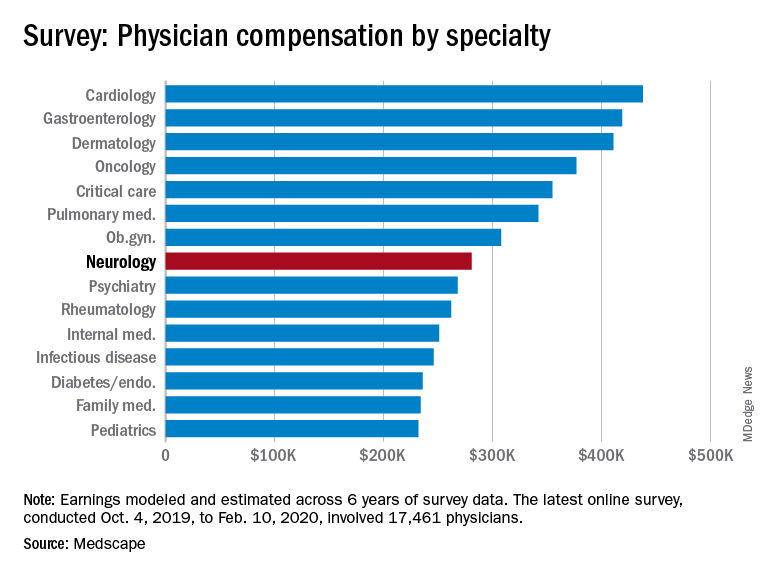

Below the middle earners

According to the Medscape Neurologist Compensation Report 2020, neurologists are below the middle earners of all physicians, earning $280,000 on average this year. That’s up from $267,000 last year. More than half of neurologists (58%) report a net worth (total assets minus total liabilities) of less than $1 million (52% men, 70% women), while 36% have a net worth between $1 and $5 million (40% men, 29% women), and 6% top $5 million in net worth (8% men, 1% women).

Among specialists, orthopedists are most likely to top the $5 million level (at 19%), followed by plastic surgeons and gastroenterologists (both at 16%), according to the Medscape Physician Debt and Net Worth Report 2020.

Conversely, about two in five neurologists (41%) have a net worth under $500,000, just below family medicine physicians (46%) and pediatricians (44%).

For roughly two thirds of neurologists (64%), their major expense is mortgage payment on their primary residence. Around one third of neurologists have a mortgage of $300,000 or less, 28% have no mortgage or a mortgage that is paid off, and 17% have a mortgage topping $500,000. Six in 10 neurologists live in a house that is 3000 square feet or smaller.

Mortgage aside, other top ongoing expenses for neurologists are car payments (35%), credit card debt (28%), school loans (25%), and childcare (19%). At 25%, neurologists are in the middle of the list when it comes to physicians still paying off loans for education.

Spender or saver?

The average American has four credit cards, according to the credit reporting agency Experian. Among neurologists, more than half said they have four or fewer credit cards, including 37% with three to four cards, 16% with one to two cards, and 1% with no cards. A little more than a quarter of neurologists (28%) have five to six credit cards and 18% have more than seven at their disposal.

Only a small percentage of neurologists (7%) say they live above their means; 57% live at their means and 35% live below their means.

More than half (59%) of neurologists contribute $1,000 or more to a tax-deferred retirement or college savings account each month, while 12% do not do this on a regular basis. About two thirds of neurologists make contributions to a taxable savings account, a tool many use when tax-deferred contributions have reached their limit.

Nearly half of neurologists (48%) rely on a “mental budget” for personal expenses, while 18% rely on a written budget or use software or an app for budgeting; 34% do not have a budget for personal expenses.

Nearly three quarters of neurologists did not experience a financial loss in 2019. Of those that did, the main causes were bad investments (10%) and practice-related issues (9%), followed by legal fees (5%), real estate loss (4%), and divorce (1%).

Among neurologists with joint finances with a spouse or partner, 62% pool their income to pay household expenses. For 12%, the person who earns more pays more of the bills and/or expenses. Only a small percentage divide bills and expenses equally (4%).

Forty-three percent of neurologists said they currently work with a financial planner or had in the past, 38% never did, and 19% met with a financial planner but did not pursue working with that person.

This article first appeared on Medscape.com.