- Premium: A premium estimated to begin at $35 per month.

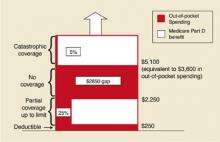

- Deductible: An annual deductible starting at $250 and indexed to increase to $445 in 2013.

- Co-pay: After paying the deductible, enrollees will pay 25% of additional drug costs up to $2250, at which point a $2850 gap in cover-age—the so-called “doughut hole”—leaves the onus of payment with the patient until $5100 is reached.

- Catastrophic coverage: After $5100, patients will pay 5% of any additional annual drug costs.

In 2006, catastrophic coverage will begin after $3600 in out-of-pocket costs ($250 deductible + $500 in co-pays to $2250 + the $2850 doughnut gap), not counting the premium. Indexing provisions are projected to raise this out-of-pocket cost requirement to $6400 in 2013. These indexing features have received less attention in the media, but may become increasingly important to seniors. For lower-income individuals, as determined by specific yearly income and total assets guidelines, a small per-prescription fee will replace the premium, deductible, and doughnut hole gap payments.

Coverage will vary. As the yearly cost of drugs changes, so will the relative contributions made by the patient and the government (Table). The new bill provides substantial benefit to those with catastrophic drug costs and to very low-income seniors. The idea of linking payments to income (for the drug benefit and the Part B premium) is a change in the Medicare program, as it has traditionally provided the same benefit to all beneficiaries, regardless of income.

Expected effects of privatization. The manner in which the drug benefit will be administered was controversial in Congress. The legislation, written primarily by Republicans, provides that beneficiaries can obtain coverage by participating with an HMO or PPO or by purchasing standalone coverage through a private prescription drug insurance program. Patient enrollment is voluntary. Managed care plans would be encouraged to participate in the prescription benefit program through eligibility for government subsidies. In turn, more beneficiaries would be encouraged to choose managed care plans, thus decreasing the number of patients covered by traditional Medicare. Furthermore, current private Medigap supplemental plans will be barred from offering drug benefits.

With the HMO/PPO and stand-alone programs, it is likely that any reduction in drug costs will result from private pharmacy benefit managers negotiating discounts from drug companies as they do now for many employer-sponsored plans. Presumably, formularies will vary from plan to plan, and it may be difficult for patients to know ahead of time whether the plan they join will cover their current medications. The legislation prohibits the government from using its vast purchasing power to negotiate substantial discounts from drug companies as it does now for the Medicaid program. There are provisions to increase availability of generic drugs, but importation of drugs from Canada is prohibited unless FDA approval is given (so far, the FDA has opposed this). Many Democrats who opposed the bill argued that it allowed too large a role for the private sector and constrained the ability of the government to control drug costs.

A final controversial measure in the bill provided for conducting an experiment in 6 cities beginning in 2010, in which at least 1 private insurance plan would be funded to compete directly with the traditional Medicare program. Many Republicans believe this type of competition is necessary to decrease the rate of cost increases in the Medicare program, while many Democrats believe the private market is a big reason for increasing problems with the quality and cost of the entire health care system.

FIGURE

Out-of-pocket spending under new legislation

Out-of-pocket drug spending in 2006 for Medicare beneficiaries under new Medicare legislation. Note: Benefit levels are indexed to growth in per capita expenditures for covered Part D drugs. As a result, the Part D deductible in projected to increase from $250 in 2006 to $445 in 2013; the catastrophic threshold is projected to increase from $5100 in 2006 to $9066 in 2013. From the Kaiser Family Foundation website(www.kff.org/medicare/medicarebenefitataglance.ctm).

Looming questions

The new Medicare legislation is vast in scope, cost, and controversy. In the coming months, a number of organizations—AARP, the Department of Health and Human Services, and various foundations—will attempt to explain its provisions to the public, most likely in different ways.

TABLE

Deciphering the 2006 drug benefit

The chart above shows what portion of yearly drug costs would be paid by the Medicare recipient and what portion would be paid by Medicare beginning in 2006. It does not include the $420 yearly premium.Family physicians may be asked by patients to explain provisions of the program and to offer advice in making decisions about their participation.